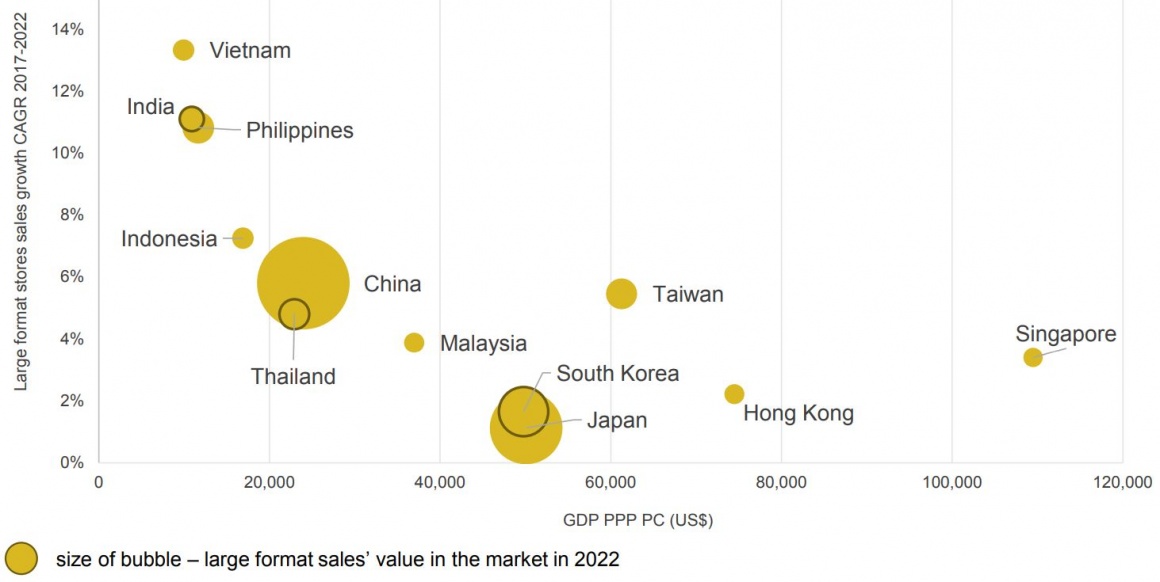

Asia’s large format retailers are set to grow 3.3 percent a year to 2022, with Vietnam, India and Philippines forecast to see double-digit growth from large format players over five years, according to global research organisation IGD.

Most of this growth is predicted to be driven by domestic retailers, except for Vietnam where foreign retailers have been investing to gain a foothold in this fast-growing market. Indonesia will have steady growth also driven mainly by domestic players, with China coming through as another market with significant growth opportunities due to its vast geography.

Many large format retailers in Asia are still enjoying steady growth through expansion although they are facing pressures from increased competition in more developed markets. More convenience stores are opening in close proximity to offices and homes, offering a good range at reasonable prices. Online retailers continue to invest heavily to gain new customers.

Besides expansion to new regions, retailers are also digitising physical stores to create a seamless shopping experience in more matured markets. Large format retailers therefore need to balance their investments in existing stores, as well as network expansion in order to stay relevant to shoppers.

On Vietnam, IGD’s Head of Asia Pacific Nick Miles said: “Vietnam is dominated by traditional trade, but modern retail is picking up pace. Saigon Co.op, a local retailer, is growing steadily and by 2022 will retain its top position.

“Foreign retailers like Central Group and Lotte Shopping are investing in large malls and building hypermarkets and supermarkets as anchors to draw shoppers. They focus on big cities like Ho Chi Minh City, Hanoi, Danang and Can Tho. Shoppers are attracted by the comfortable shopping environment and the variety of goods available at large format stores.”

On India, Nick Miles said: “India’s modern grocery retail landscape is highly fragmented. Future Retail and Reliance Retail have established stores throughout India, but strong regional players exist, for example, D-Mart.

“New entrants to the market usually focus on building their distribution within a tight geography to focus their investment and create efficiency in the supply chain. It is also easier to build a presence within a smaller region and win shoppers’ trust as they get familiar with the banner and its offerings.”

On the Philippines, Nick Miles commented: “There are great opportunities for modern retail growth in the Philippines. Local retailers are well established, with large format stores maintaining strong growth through network expansion. Retailers are adding stores in major urban cities and new regions like the Visayas and Mindanao. SM Retail is expected to grow faster than its competitors to 2022, extending its leadership over the other players in the market.”

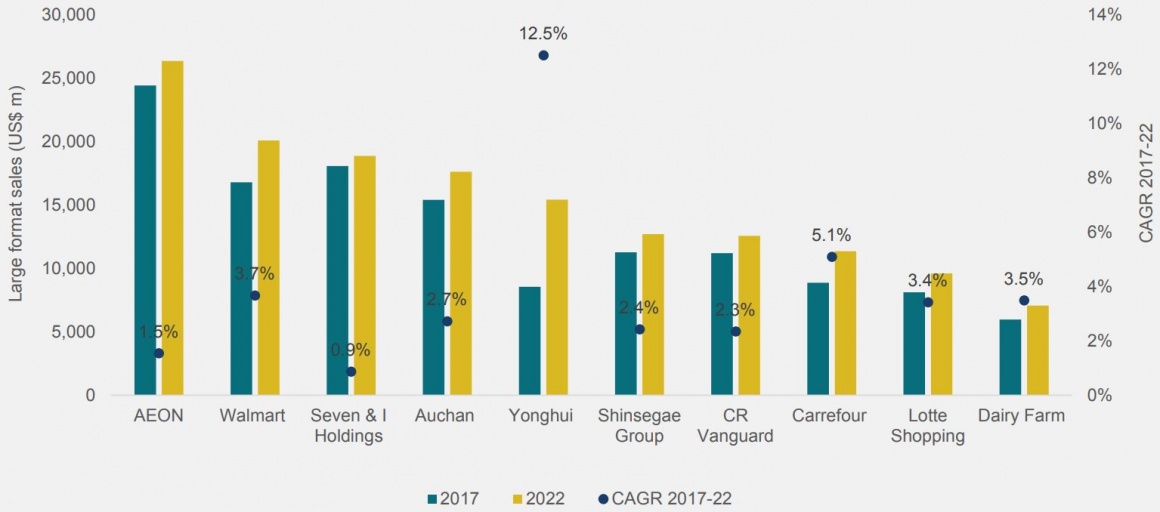

Regarding China, Nick Miles said: “China is a large and fragmented market. It is very challenging for retailers to build scale at a national level. Yonghui has been driving growth aggressively and has successfully grown from a regional player to having national presence. We expect it to rise up the ranking to second position by 2022 from fourth in 2017.

“Auchan Group has become very successful through its partnership with local retailer Sun Art. Alibaba has taken a stake in Sun Art to help drive its digital strategy. Despite slower growth, it will retain its leadership spot.”