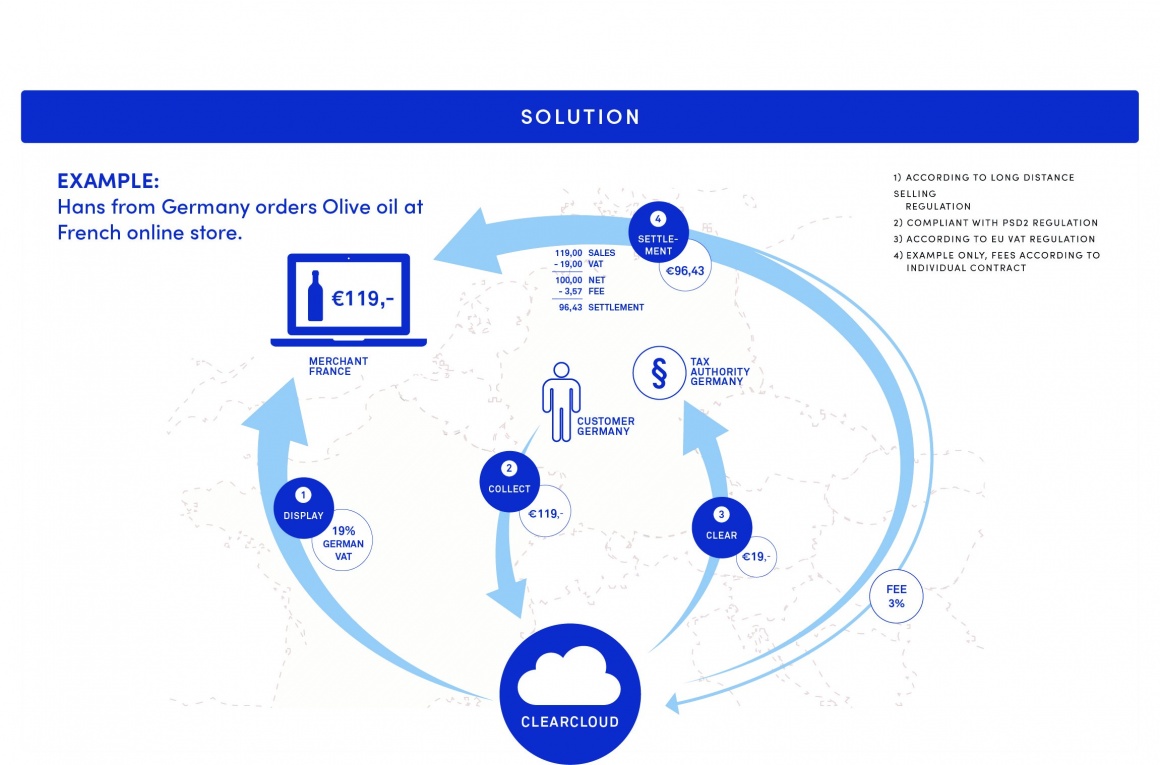

Anyone who sells goods online is obliged to pay value-added tax (VAT). The amount depends on the respective national regulations. But what happens if you have cross-border exports and transactions? How much VAT do sellers have to pay in this case and who must they pay these taxes to? Berlin-based ClearVAT AG has developed a software solution that simplifies this complex process for e-commerce businesses and ensures full compliance with VAT regulations.

Here is what the law says: as a supplier of products to EU end consumers, you’re legally obligated to register for VAT, charge, collect, report, and submit this Europe-specific tax to individual governments in the specific country. This applies across all 28 EU member states and their various VAT rates. The problem is that online retailers generally sell their items to customers in more than one country. The numerous regulations pertaining to tax collection, payments, and registration requirements quickly lead to confusion. That’s where many retailers lose track or are simply not fully aware of all their tax obligations. But ignorance of the law is not an excuse. Section 370 of the Fiscal Code of Germany defines tax evasion as a criminal offense and punishable by fines and possible jail time.

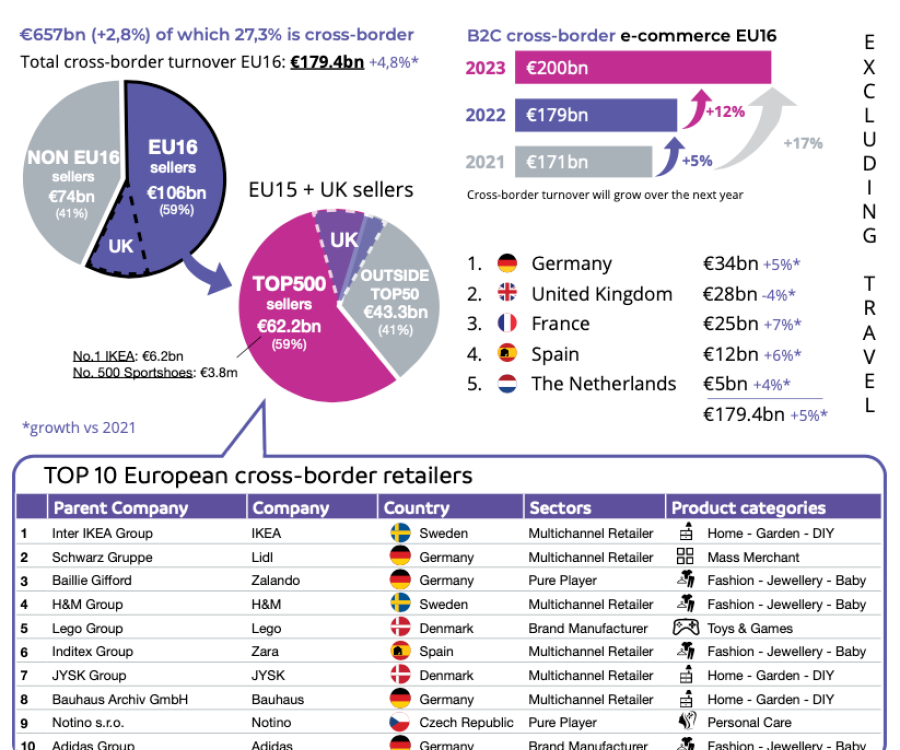

“The problem is that there is no de facto pan-European market for e-commerce retailers," Roman Maria Koidl, founder and CEO of ClearVAT AG summarizes the present situation. The startup offers e-commerce retailers a software solution that handles the automatic VAT collection, payment and reporting within the European Union. “Retailers only need to install our plug-in and have a contract with us and are then ready to deliver to all 28 member states of the EU," explains Koidl. At present, ClearVAT offers online retailers the following services: the DISPLAY and THRESHOLD CONTROL solutions ensure that the currently valid VAT rates are correctly assessed and delivered on the respective online platform based on the country from which the buyer or delivery recipient originates. The COLLECT & CLEAR solution makes sure VAT is collected and reported automatically based on the thresholds set by each EU country.

For his project, Koidl was able to attract well-known people like the former German Minister of Finance and chancellor-candidate of the Social Democratic Party (SPD) Peer Steinbrück, who is the Chairman of ClearVAT’s supervisory board. "ClearVAT makes an important contribution to fair taxation," says Steinbrück. “Europe is still in the early stages as it pertains to VAT concerns. Policy-makers have struggled for over ten years and this technology finally manages to tackle the issue with a simple, practical and fair solution that ensures full compliance with retailers’ obligations.”

The European Commission is also acutely aware of the problems resulting from the current EU Vat system. In 2016, it presented an Action Plan outlining steps towards a single EU VAT area. Yet apart from a series of proposals that were written up within the Commission shortly afterwards, not much has been accomplished since then and it’s clear that they are not part of the most current agenda. Instead, it is highly likely that the applicable VAT laws and regulations will actually stay on any EU merchant’s agenda for some time to come.

Of course, e-commerce doesn’t stop at the borders of the European Union. That’s why ClearVAT also has plans in the works for this type of trade: the company plans to launch a new product in mid-2020, designed to regulate exports from the EU to Switzerland, Norway and the United Kingdom. DECLARE is a customs solution that ensures that goods are no longer held at customs, but are allowed to pass through seamlessly. By the end of 2021, the company also plans to offer the solution to facilitate imports into the EU by third countries.